Table of Contents

Introduction

Cryptocurrency has evolved from a tech experiment to a trillion-dollar asset class that’s reshaping how we think about money. Just over a decade ago, Bitcoin was worth pennies. Today, it’s a household name alongside traditional investments like stocks and bonds.

This digital revolution isn’t just changing finance—it’s creating entirely new ways to build wealth. From simple buy-and-hold strategies to complex decentralized finance protocols, crypto offers opportunities that didn’t exist in traditional markets.

But here’s the thing: crypto can feel overwhelming. The terminology is confusing, the technology seems complex, and the volatility can be stomach-churning. That’s exactly why we’re breaking it down for you.

This guide will explain what cryptocurrency actually is, how it works, and most importantly, how you can potentially profit from it. We’ll cover everything from basic investing strategies to advanced techniques, plus the risks you need to know about before diving in.

Ready to understand crypto and explore how to make money from it? Let’s get started.

What Is Cryptocurrency?

Cryptocurrency is digital money that exists merely online. Unlike traditional currencies, which are controlled by governments and banks, it operates on decentralized networks that no single entity controls it.

Think of it this way: when you use a credit card, your bank verifies and processes the transaction. With crypto, a network of computers around the world handles this verification through something called blockchain technology.

Key Characteristics That Make Crypto Different

Decentralization means no central authority controls this digital currency. Instead of relying on banks or governments, transactions are verified by a distributed network of computers.

Transparency and immutability: Every transaction is recorded on a public ledger that can’t be altered or deleted. Once a transaction is confirmed, it’s permanent.

Limited supply is built into many cryptocurrencies. Bitcoin, for example, will only ever have 21 million coins. This scarcity can drive value over time, similar to precious metals.

Popular Cryptocurrencies You Should Know

Bitcoin (BTC) is one of the most renowned cryptocurrencies and is often called “digital gold.” It’s the most recognized and widely accepted cryptocurrency around the world

Ethereum (ETH) goes beyond simple transactions. It enables smart contracts and decentralized applications, making it the foundation for much of the crypto ecosystem.

Binance Coin (BNB) powers the Binance exchange ecosystem and offers utility for trading fee discounts and other services.

Solana (SOL) focuses on fast, cheap transactions and has become popular for NFTs and decentralized applications.

Stablecoins like USDT and USDC are pegged to the US dollar, offering stability in an otherwise volatile market.

How Cryptocurrency Actually Works

Blockchain technology is the backbone of cryptocurrency. Imagine a digital ledger that’s copied across thousands of computers worldwide. When you make a transaction, the network verifies it and adds it to the ledger. Once added, it can’t be changed or deleted.

Mining and validation keep the network secure. Miners use computer power to solve complex mathematical problems that verify transactions. In return, they earn cryptocurrency rewards.

You control your crypto through Wallets and private keys. Your wallet is like a bank account, but instead of a password, you have a private key—a long string of characters that proves ownership. Once you lose your private key, you will lose access to your crypto forever.

How to Make Money from Crypto

Now for the part you’ve been waiting for—how to make a profit from cryptocurrency. There are several strategies through which you can earn, each with different risk levels and potential returns.

Buying and Holding (HODLing)

This is the simplest strategy and often the most effective for beginners. You buy cryptocurrency and hold it for months or years, betting that it will increase in value over time.

HODLing works best with established cryptocurrencies such as Bitcoin and Ethereum. These have proven track records and are more likely to survive market downturns.

The risks include market volatility and the possibility that your chosen cryptocurrency could lose value or become obsolete over time. The rewards can be real, as you can see, early Bitcoin holders have earned profits of thousands of dollars.

Trading Cryptocurrencies

Another way through which one can earn from this digital currency is through active trading means buying and selling crypto to profit from price movements. Day traders hold positions for hours or days, while swing traders hold for weeks or months.

There are several Popular exchanges for trading, including Binance, Coinbase, and Kraken. These platforms offer plenty of trading tools and support hundreds of different cryptocurrencies.

If you want to be a Successful trader and earn a good amount of money, it requires technical analysis, such as studying price charts, and fundamental analysis (researching the underlying projects). It’s more time-intensive than holding and requires developing specific skills.

Staking and Yield Farming

Staking lets you earn interest on your cryptocurrency holdings. When you stake coins like Ethereum or Cardano, you’re helping secure the network and earning rewards in return.

Yield farming involves providing liquidity to decentralized finance (DeFi) platforms like Uniswap or Aave. You deposit your crypto into liquidity pools and earn fees from trading activity.

The main risks include impermanent loss (where the value of your deposited tokens changes relative to each other) and protocol failure (where the platform gets hacked or fails).

Mining Cryptocurrency

Mining involves using computer hardware to verify transactions and secure the network. Miners earn cryptocurrency rewards for their work.

Bitcoin mining requires specialized hardware called ASICs and consumes significant electricity. Ethereum switched from mining to staking in 2022, but other cryptocurrencies still use mining.

For most individuals, mining has become less profitable due to increased competition and energy costs. It’s now dominated by large operations with cheap electricity and economies of scale.

Earning Through Airdrops and Forks

Another way to earn profit from crypto is airdrops. Airdrops are free cryptocurrency distributions to existing holders or active users of a platform. Projects use airdrops to reward early adopters or generate buzz.

Notable examples include the Uniswap airdrop in 2020, where users received $UNI tokens worth thousands of dollars for simply using the platform.

Forks occur when a blockchain splits into two separate chains. Bitcoin Cash (BCH) was created from a Bitcoin fork, and Bitcoin holders received equivalent BCH tokens for free.

Crypto Lending and Borrowing

Platforms like BlockFi, Nexo, and Aave allow you to earn interest by lending your cryptocurrency to other users. Interest rates vary but can be significantly higher than traditional savings accounts.

You can also borrow against your crypto holdings without selling them. This is useful if you need cash but want to maintain your crypto exposure.

The main risks in crypto lending and borrowing include platform security (centralized platforms can be hacked) and counterparty risk (borrowers might default on loans).

NFTs and Play-to-Earn Games

Non-fungible tokens (NFTs) represent unique digital assets like art, collectibles, or game items. Some people have made significant profits buying and selling NFTs, though the market has cooled considerably from its 2021 peak.

Play-to-earn games like Axie Infinity and StepN allow players to earn cryptocurrency by playing games or completing activities. These games often require initial investments in NFTs or tokens.

The NFT and gaming sectors are highly speculative and volatile. Success often depends on timing, community adoption, and the long-term viability of specific projects.

Affiliate Programs and Content Creation

Many crypto exchanges and services offer affiliate programs where you earn commissions for referring new users. Binance, Coinbase, and other platforms have popular affiliate programs.

Creating educational content about cryptocurrency on YouTube, X (formerly Twitter), or Medium can generate income through sponsorships, ad revenue, and affiliate marketing.

Building an audience takes time and consistency, but successful crypto content creators can earn substantial income from multiple revenue streams.

Risks and Considerations

each business contains risk. Cryptocurrency investing isn’t without significant risks that you need to understand before putting money in it.

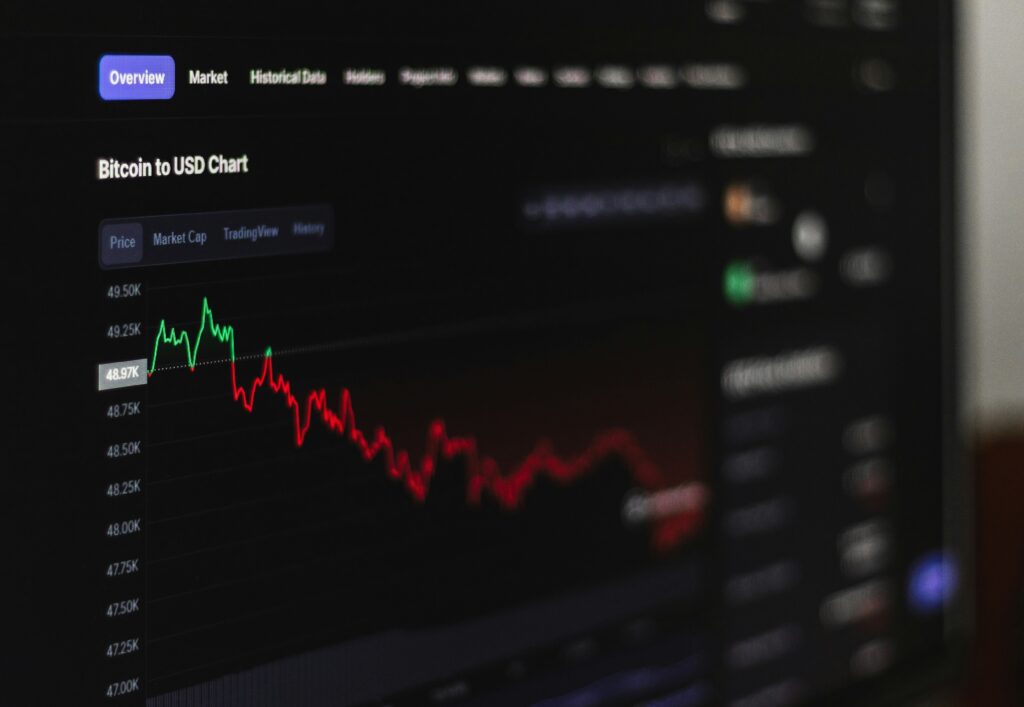

Market volatility is perhaps the biggest challenge. Bitcoin has experienced multiple crashes of 50% or more, and smaller cryptocurrencies can be even more volatile. Prices can swing dramatically based on news, regulations, or market sentiment.

Scams and rug pulls are, unfortunately, common in the crypto space. Fraudulent projects may promise unrealistic returns or simply disappear with investors’ money. Always research projects thoroughly and be skeptical of guaranteed returns.

Regulatory uncertainty remains a major factor. Governments worldwide are still figuring out how to regulate cryptocurrency, and new rules could significantly impact prices and accessibility.

Security concerns are real and costly. Exchange hacks have resulted in billions of dollars in losses. Even more concerning, if you lose your private keys or seed phrase, your crypto is gone forever with no way to recover it.

Tools and Resources for Crypto Success

Having the right tools makes crypto investing much easier and safer.

Exchanges are where you’ll buy, sell, and trade cryptocurrency. Binance offers the widest selection of cryptocurrencies and advanced trading features. Coinbase provides a user-friendly interface perfect for beginners. Kraken offers strong security and good customer support.

Wallets store your cryptocurrency. Software wallets like MetaMask and Trust Wallet are convenient for active trading and DeFi activities. Hardware wallets like Ledger devices offer the best security for long-term storage.

Information and analytics platforms help you make informed decisions. CoinMarketCap and CoinGecko provide price data, market statistics, and project information. CryptoPanic aggregates news from multiple sources to help you stay updated.

Education is crucial for success. YouTube channels, Reddit communities, and online courses offer valuable learning opportunities. However, always verify information from multiple sources and be wary of get-rich-quick schemes.

Making Smart Moves in Crypto

Cryptocurrency represents a fundamental shift in how we think about money and investing. From simple buy-and-hold strategies to complex DeFi protocols, there are numerous ways to potentially profit from this digital revolution.

The key strategies we’ve covered—holding, trading, staking, mining, and others—each offer different risk-reward profiles. Start with what matches your comfort level and experience. Many successful crypto investors began with simple buying and holding before exploring more advanced strategies.

Keep in mind that cryptocurrency is still a relatively new and evolving field. What works today might not work tomorrow. Stay curious, keep learning, and never invest more than you can afford to lose.

The future looks bright for blockchain technology and cryptocurrency adoption. Web3, DeFi, and digital assets are becoming increasingly mainstream. Whether you’re seeking portfolio diversification or exploring entirely new investment opportunities, cryptocurrency offers unique possibilities that didn’t exist just a few years ago.

Start small, do your research, and remember that the best time to learn about crypto was yesterday. The second-best time is right now.

Conclusion

Cryptocurrency has opened the door to a new financial frontier, blending cutting-edge technology with unprecedented opportunities for wealth creation. From Bitcoin’s rise as digital gold to Ethereum’s smart contract revolution, the crypto space offers diverse paths to profit, whether through patient holding, strategic trading, or innovative DeFi ventures. However, with great potential comes great responsibility. The volatility, scams, and regulatory uncertainties demand caution, thorough research, and a clear-eyed approach to risk management. By starting small, leveraging trusted tools like Binance, Coinbase, or hardware wallets, and staying informed through platforms like CoinMarketCap, you can navigate this dynamic landscape with confidence. The crypto revolution is just beginning, and whether you’re diversifying your portfolio or chasing bold new opportunities, now is the time to take your first step into this transformative world. Embrace the learning curve, stay disciplined, and seize the potential of this digital era.

FAQS

1. What is cryptocurrency, and why is it so popular?

Cryptocurrency is digital money that operates on decentralized blockchain networks, free from control by governments or banks. Its popularity stems from its potential for high returns, decentralization, transparency, and ability to enable new financial systems like DeFi and NFTs. For example, Bitcoin’s rise from pennies to thousands of dollars has drawn global attention.

2. Is cryptocurrency a safe investment?

Cryptocurrency is high-risk due to extreme price volatility (e.g., Bitcoin’s 50%+ crashes), scams, regulatory uncertainty, and security threats like exchange hacks. However, it can be safer with proper precautions: using reputable platforms, securing private keys, and only investing what you can afford to lose. Always research thoroughly to avoid scams.

3. How do I buy cryptocurrency?

To buy cryptocurrency:

- Choose a reputable exchange like Binance, Coinbase, or Kraken.

- Create an account and complete identity verification (KYC).

- Deposit funds (via bank transfer, card, etc.).

- Select a cryptocurrency (e.g., Bitcoin, Ethereum) and place a buy order.

- Store your crypto in a secure wallet, like MetaMask (software) or Ledger (hardware).

4. What is a private key, and why is it so important?

A private key is a unique string of characters that proves ownership of your cryptocurrency. It’s like a password for your crypto wallet. Losing your private key means losing access to your funds permanently, as there’s no central authority to recover them. Always store private keys securely, preferably offline.

5. What’s the difference between Bitcoin and Ethereum?

- Bitcoin (BTC): A decentralized digital currency, often called “digital gold,” designed for peer-to-peer transactions and as a store of value.

- Ethereum (ETH): A blockchain platform that supports smart contracts and decentralized applications (dApps), powering much of the DeFi and NFT ecosystems. While Bitcoin focuses on being a currency, Ethereum is a broader technology platform.

6. Can I make money with cryptocurrency without trading?

Yes, there are several ways to profit without active trading:

- HODLing: Buying and holding crypto long-term (e.g., Bitcoin or Ethereum).

- Staking: Earning interest by locking up coins like Cardano or Ethereum to support the network.

- Yield Farming: Providing liquidity to DeFi platforms like Uniswap for fees.

- Airdrops: Receiving free tokens from projects for holding or using their platform.

- Crypto Lending: Earning interest by lending crypto on platforms like Aave.

- Play-to-Earn Games: Earning tokens through games like Axie Infinity.

7. Are cryptocurrencies legal?

Cryptocurrency legality varies by country. In the US, UK, and many others, crypto is legal but regulated, with rules on taxation and trading. Some countries, like China, have stricter bans or limitations. Always check your local regulations, as changes can impact prices and accessibility.

8. How do I avoid crypto scams?

To avoid scams:

- Research projects thoroughly, checking whitepapers, teams, and community feedback.

- Avoid “guaranteed returns” or get-rich-quick schemes.

- Use trusted exchanges and wallets (e.g., Coinbase, Ledger).

- Be wary of unsolicited offers or phishing attempts asking for your private keys.

- Verify information on platforms like CoinGecko or CryptoPanic.

9. What are stablecoins, and why are they important?

Stablecoins (e.g., USDT, USDC) are cryptocurrencies pegged to assets like the US dollar, minimizing volatility. They’re widely used for trading, DeFi, and as a safe haven during market dips. Their stability makes them essential for transactions and liquidity in the crypto ecosystem.

10. Why are crypto prices so volatile?

Crypto prices fluctuate due to:

- Market Sentiment: News, social media (e.g., posts on X), or influencer opinions can drive rapid price swings.

- Low Liquidity: Smaller cryptocurrencies have less trading volume, amplifying price changes.

- Regulatory News: Government policies or crackdowns can impact markets.

- Speculation: Many investors trade based on short-term price predictions, increasing volatility.

11. What is DeFi, and is it safe?

Decentralized Finance (DeFi) refers to blockchain-based financial applications (e.g., Uniswap, Aave) that enable lending, borrowing, and trading without intermediaries. While DeFi offers high returns through yield farming or staking, risks include:

- Impermanent Loss: Value changes in liquidity pools.

- Smart Contract Bugs: Code vulnerabilities can lead to hacks.

- Protocol Failures: Projects may fail or get exploited. Research platforms carefully and diversify.

12. Should I invest all my money in one cryptocurrency?

No, diversification is key. Investing everything in one crypto increases risk, as a single project’s failure or price crash could wipe out your funds. Spread investments across established coins (e.g., Bitcoin, Ethereum) and other assets to balance risk.

13. What’s the deal with NFTs? Are they worth investing in?

Non-fungible tokens (NFTs) are unique digital assets (e.g., art, collectibles) on the blockchain. They gained hype in 2021, with some selling for millions, but the market is highly speculative and has cooled since. Success depends on project quality, timing, and demand. Research carefully, as many NFTs lose value.

14. How do taxes work with cryptocurrency?

Crypto tax rules vary by country. In the US, crypto is treated as property, so buying, selling, or trading triggers capital gains taxes. Earning crypto (e.g., via staking or airdrops) may be taxed as income. Keep detailed records of transactions and consult a tax professional for compliance.

15. Can I recover my crypto if I lose my private key?

No, losing your private key means losing access to your cryptocurrency permanently, as there’s no central authority to reset it. Always back up your private key or seed phrase in a secure, offline location (e.g., a hardware wallet or written on paper stored safely).